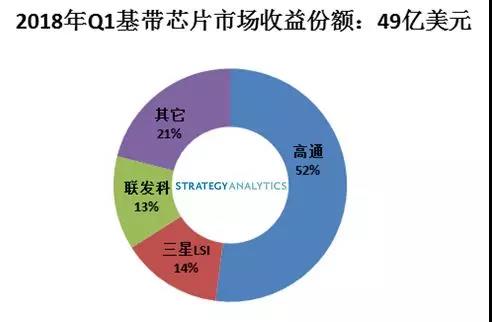

Strategy Analytics mobile phone component technology research service, the latest research report, "Q1 baseband chip market share tracking in 2018: Samsung LSI over coalition" pointed out that in 2018, the Q1 global honeycomb baseband processor market increased by 0.3% to $4 billion 900 million year on year.

The Strategy Analytics study reported that 2018 Q1, high Qualcomm, Samsung LSI, Co, Hass and UNISOC (exhibition and RDA) got the first five in the global honeycomb baseband processor market. In 2018, Q1 Qualcomm continued to win market share, maintaining its first share of 52% base band revenue. Then came Samsung LSI, which accounted for 14%, and Mixed Development Section, which accounted for 13%.

In 2018, Q1, the LTE baseband chip market continues to be the only positive player, with a growth rate of up to 9%, while the 2G and 3G baseband chip market segments have a two digit decline.

In 2018, Q1 MediaTek and UNISOC (RDA) continued to lose market share.

Altair, Hass, Intel, Qualcomm, Sequans and Samsung LSI achieved a year-on-year increase in baseband chip shipments in 2018 Q1.

Sravan Kundojjala, deputy director of Strategy Analytics, said, "Samsung LSI is the main beneficiary of the 3G to 4G transformation; it surpassed the coalition in 2018 and accounted for second of the revenue share in the baseband market. In the past ten years, after many high-end baseband market withdrew, Samsung LSI intervened to fill the gap of its main customers Samsung mobile. Strategy Analytics believes that Samsung LSI's LTE baseband technology, product mix and integration capabilities are now in the same camp with market leader Qualcomm. However, Samsung LSI has so far not been very popular outside its internal customer Samsung mobile. Strategy Analytics believes that the current global trade war has opened up a rare opportunity for Samsung LSI as a Korean company to compete for external baseband chips. How the company is going to deal with it is still to be seen.

Stuart Robinson, executive director of Strategy Analytics mobile component technology services, said, "in 2018, the Q1 Federation and UNISOC (exhibition and RDA) continued to lose market share, and both companies' baseband chip shipments were on the two digit decline for fourth consecutive quarters. MediaTek showed signs of recovery at the end of Q1 in 2018 and is expected to perform better in the rest of 2018. UNISOC (RDA and LTE) still lag behind competitors in terms of product strength although they are gaining momentum in the mobile phone. The joint development section and UNISOC (exhibition and RDA) all need to solve the weaknesses of their current product portfolio and gain a place in the 5G market to compete with the rapidly developing Qualcomm Corp.

Christopher Taylor, director of Strategy Analytics radio frequency and wireless component research services, added: "in 2018, the third consecutive quarterly shipments of Q1 high Qualcomm increased year-on-year, thanks to the company's gain in share from Chinese mobile phone manufacturers. Following the key role of the commercialization of multimode LTE smartphones, the Qualcomm Corp will rely on its pioneering efforts to repeat the performance in the multimode 5G new radio (NR). In addition to mobile phones, Qualcomm is also developing in the field of cellular tablet computers, Internet of things and automotive baseband.

Strategy Analytics predicts that the non cell phone baseband market will account for 10% of the total Q1 base band shipments of Qualcomm in 2018, and its growth rate is higher than that of the mobile phone market.