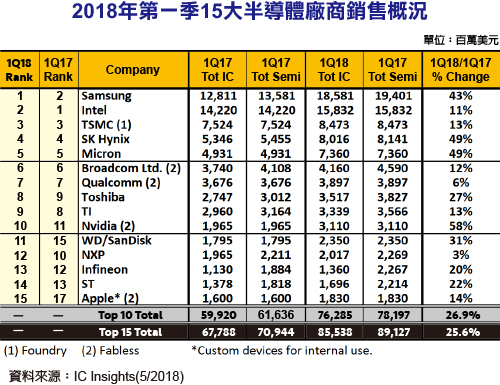

Set micronet news, IC Insights published the first quarter of 2018 semiconductor industry revenue profile. Overall, the first 15 semiconductor companies grew 26% compared with the first quarter of 2017, and the overall semiconductor industry grew by about 20%. Surprisingly, Samsung, SK Hynix and micron three memory suppliers grew more than 40% in the first quarter compared with the same period last year. With the strong growth of DRAM and NAND Flash for a whole year, Samsung's first quarter sales figures were still lagging behind Intel 5% in the first quarter of 2017, but revenue in the first quarter of 2018 was much more than Intel's 23%. Intel also took the lead in the first quarter of 2017, but lost its 20 year advantage since 1993 in the second quarter of 2017 and throughout the year.

It is noteworthy that memory accounts for 83% of Samsung Semiconductor's first quarter sales, up 6% from 77% in the first quarter of 2017, up 12% from 71% a year ago. In addition, the non memory sales of the company in the first quarter of 2018 amounted to $3 billion 300 million, up 6% compared to 1Q17's non memory sales of $3 billion 150 million.

The IC Insights report also points out that the top 15 top semiconductor suppliers in the world include a pure wafer generation plant and four IC design companies; if TSMC is excluded from the top 15, the Taiwan IC design manufacturer ($1 billion 696 million) will be ranked fifteenth.